portability estate tax definition

The non-exempted amount of 545 million would be portable and would be passed to his wife. Portability Estate Tax Definition.

Advanced Estate Planning Ppt Download

However that exemption is scheduled to.

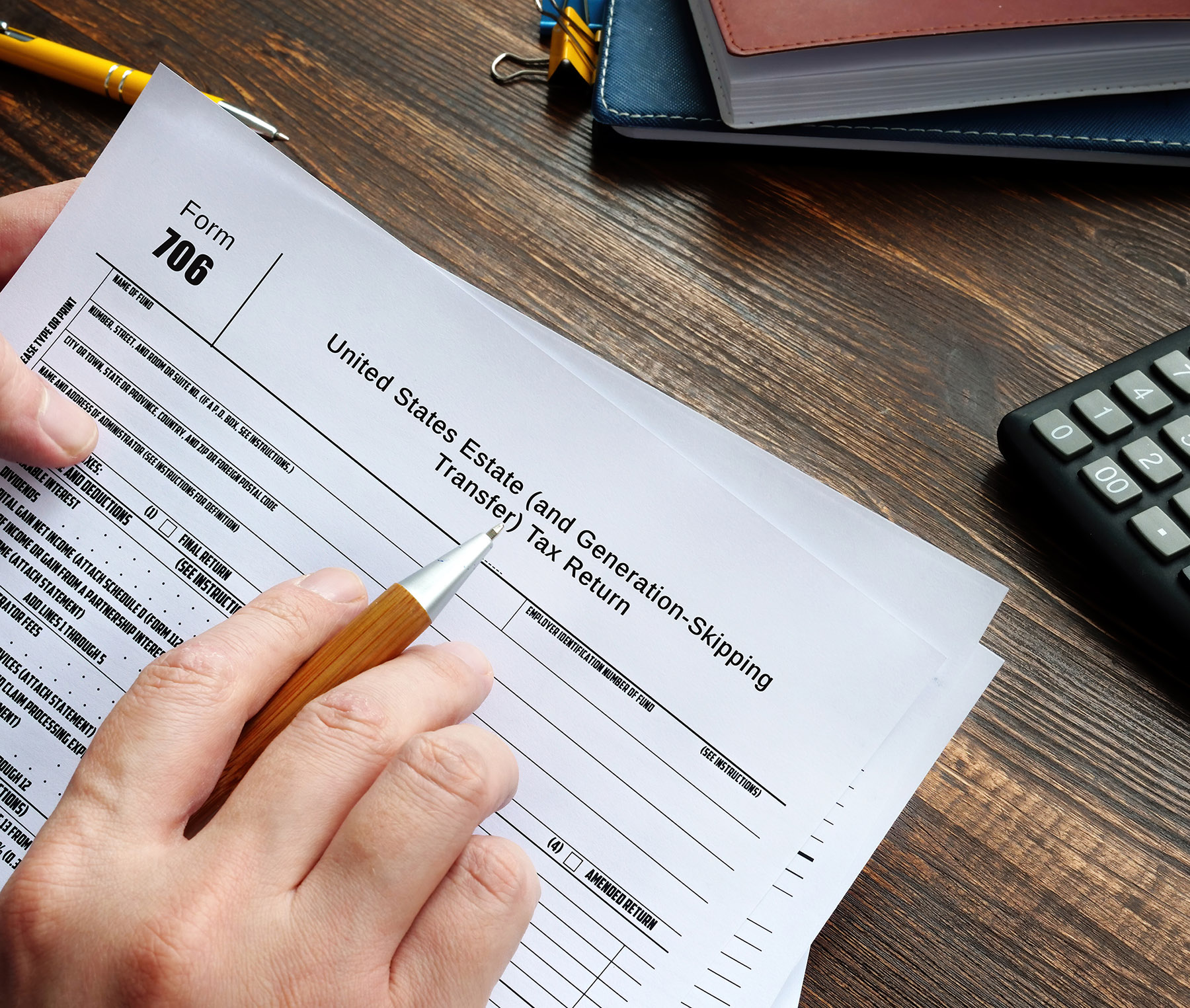

. Entries for the gross estate in the US the taxable. In this example that is nearly 8 million. When computing the DSUE amount Code Sec.

Portability law is a fairly recent law in the last couple of years. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. Portability is the ability for the surviving spouse to use the deceased spouses unused estate and gift tax exclusion after the deceased spouses death.

Attach a statement to the return that refers to the particular treaty applicable to the estate and write that the estate is claiming its benefits. Portability has been part of the law since. The wife has to file the IRS Form 706 federal estate tax returns to get the portability within.

Apply for Portability when you apply for Homestead Exemption on your new property. What happened was in the old days when someone would come into my office lets say the surviving. The exemption is subtracted from the value of estate assets with the result being subject to the estate tax.

The effect of portability is that a married couple has a combined 234 million exemption from the federal estate and gift tax and a combined 10 million exemption from the Maryland estate. Thus Jennifers estate will owe about 1064000 in estate taxes after her death. 2010 c 4 refers to the amount with respect to which the tentative tax is determined under Code Sec.

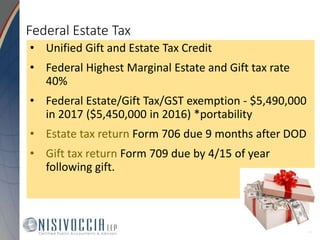

Portabilitys Effect on Tax-Efficient Estate Tax Planning. The federal estate tax law was amended in 2013 to permit the executor of the estate of the first deceased spouse to give any unused unified credit to the surviving spouse. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013.

The portability election is made. Normally you have 9. Without portability they will pay taxes on the difference between the value of your estate and the current estate tax exemption.

The key is to file for estate tax portability on time. 2660000 taxable estate x 40. The estate tax portability rules save your estate from almost being cut in half when sent to your heirs.

8000000 estate 5340000 exemption 2660000 taxable estate. Again to elect portability the deceased spouses estate has to file an estate tax return and if that isnt otherwise required that introduces some complexity and some cost into that process. If our office denies your portability application you will have an opportunity to file an appeal with Palm.

2001 b 1 on the. Currently the federal estate tax exemption is 11400000 per spouse. The Estate Tax is a tax on your right to transfer property at your death.

Estate Tax Portability What It Is And How It Works

Estate Tax Planning In Florida And Portability Estate Planning Attorney Gibbs Law Fort Myers Fl

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

Estate Planning With Portability In Mind Part Ii The Florida Bar

Attorney At Law Portability And Your Estate Plan Tbr News Media

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

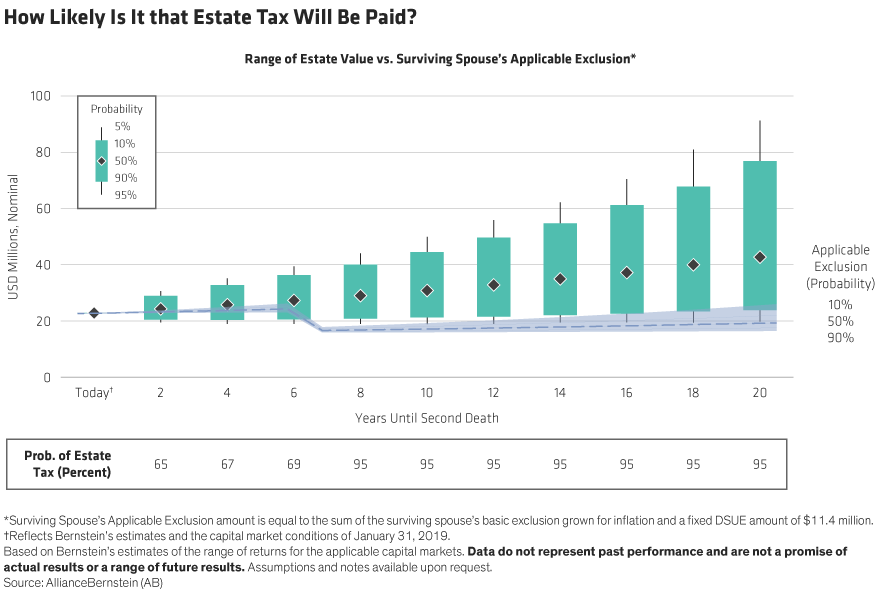

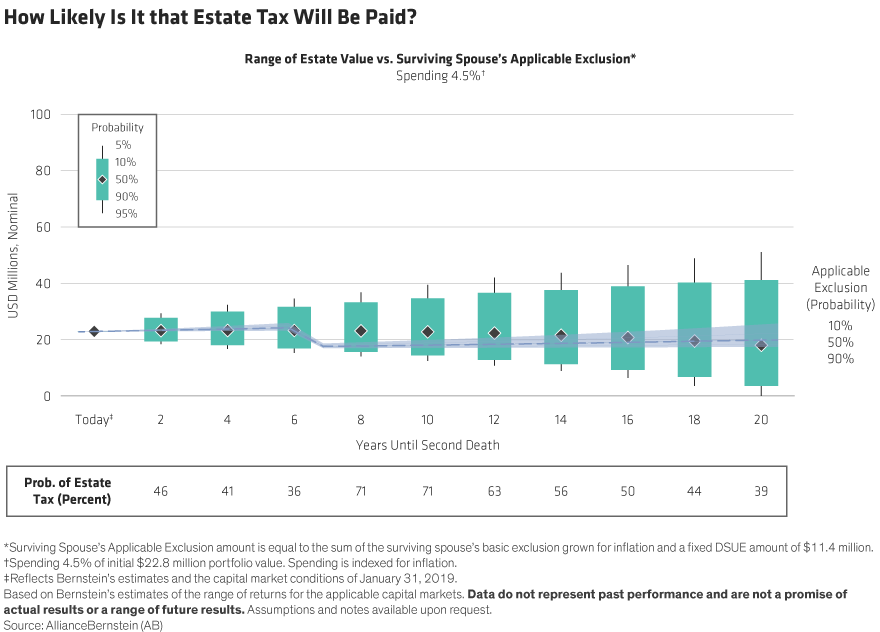

Will Your Estate Be Taxable In The Future Context Ab

This Strategy Can Double Your Estate Tax Exemption Investmentnews

How Portability Dsue For Estate And Gift Taxes Could Save You Millions No Really Atticus Magazine

New Irs Requirements To Request Estate Closing Letter

Will Your Estate Be Taxable In The Future Context Ab

Nj Estate And Inheritance Tax 2017

Dsue Issues The Promise And Pain Of Portability

Late Portability Election New Relief Available New York Law Journal

Portability Of The Estate Tax Exemption How It Works

Understanding Qualified Domestic Trusts And Portability

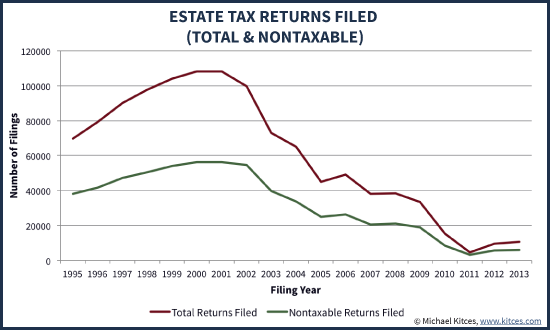

Exploring The Estate Tax Part 1 Journal Of Accountancy

Estate Planning With Portability In Mind Part Ii The Florida Bar