IR35

Wed like to set additional cookies to understand how you use GOVUK. And in a surprising twist IR35 changes off-payroll working rules will be repealed from April.

5 Ways Private Sector Companies Can Prepare For Ir35 Tax Legislation Srg

The IR35 tax avoidance reforms were first introduced in the public sector back in April 2017 and ushered in a sizeable shift in responsibility within the extended end-client-to.

. Chancellor Kwasi Kwarteng has pledged to simplify so-called IR35 rules which affect self-employed individuals operating through a company in. Search and apply for the latest Work from home jobsVerified employers. IR35 has become the nickname for HMRCs off-payroll working rules that are part of the Finance Act.

September 23 2022 134 pm. Speaking to the House of Commons today September 23 Chancellor Kwasi. We use some essential cookies to make this website work.

Dave Chaplin CEO of IR35 compliance solution IR35 Shield explores and explains what these changes could be and. It is aimed at combatting tax avoidance by workers typically contractors and freelancers who supply their. The governments sudden repeal of the IR35 changes introduced to the public sector in 2017 and the private sector in 2021 has come as a surprise to all in HR and.

The calculator assumes you work 5 days per week 44 weeks per year. Full-time temporary and part-time jobsJob email alerts. Fill in the yellow boxes to calculate your net income inside and outside IR35.

How to use the IR35 calculator. The off-payroll working rules apply on a contract-by-contract basis. Search and apply for the latest Lead automation engineer jobs in Edinburgh IN.

List of information about off-payroll working IR35. The definition of small business for IR35 exemptions is likely to be based on the definition in the Companies Act which is met if a company meets any two of the three triggers below. What Is the IR35 Legislation.

In general IR35 shifts the responsibility of worker. There are many ways to break into cyber security entry level jobs and with the increasing threat of cyber crime workplace demand is greater than ever. The term IR35 refers to the press release that originally announced the legislation in 1999.

The IR35 reform will be repealed from April 6 2023 according to this mornings mini-Budget. Full-time temporary and part-time jobs. IR35 was introduced in 2000 and the IR35 rules became law via the Finance Act 2000.

Changes to IR35 were outlined in the recent mini-budget. A contract for the purpose of the off-payroll working rules is a written verbal or implied agreement between parties. IR35 also known as the Off-Payroll Working Rules may apply when the freelancer operates under a personal services or similar company.

Free fast and easy way find. IR35 reforms introduced in the public sector in 2017 and the private sector in 2021 meant that the responsibility for determining a contractors worker status shifted to the. The original press release outlining the details was called.

IR35 is tax legislation intended to stop disguised employment. On September 23 the UK Government announced their mini-budget. A shortage in trained cyber security.

Ir35 Rules Are Changing Here S How To Prepare Finerva

Ir35 Changes From 6 April Explained Rocket Lawyer Uk

Off Payroll Working Rules Ir35 Faqs

Working Practices Reflecting Genuine Outside Ir35 Assignment

Ir35 Legislation And How It Impacts Businesses In 2020

What Is Ir35 Off Payroll Working

What Is Ir35 Does It Apply To You How Much Are The Extra Taxes

Breaking Down Ir35 For Agencies Wishu

What Is Ir35 Here S What You Need To Know Freshbooks Blog

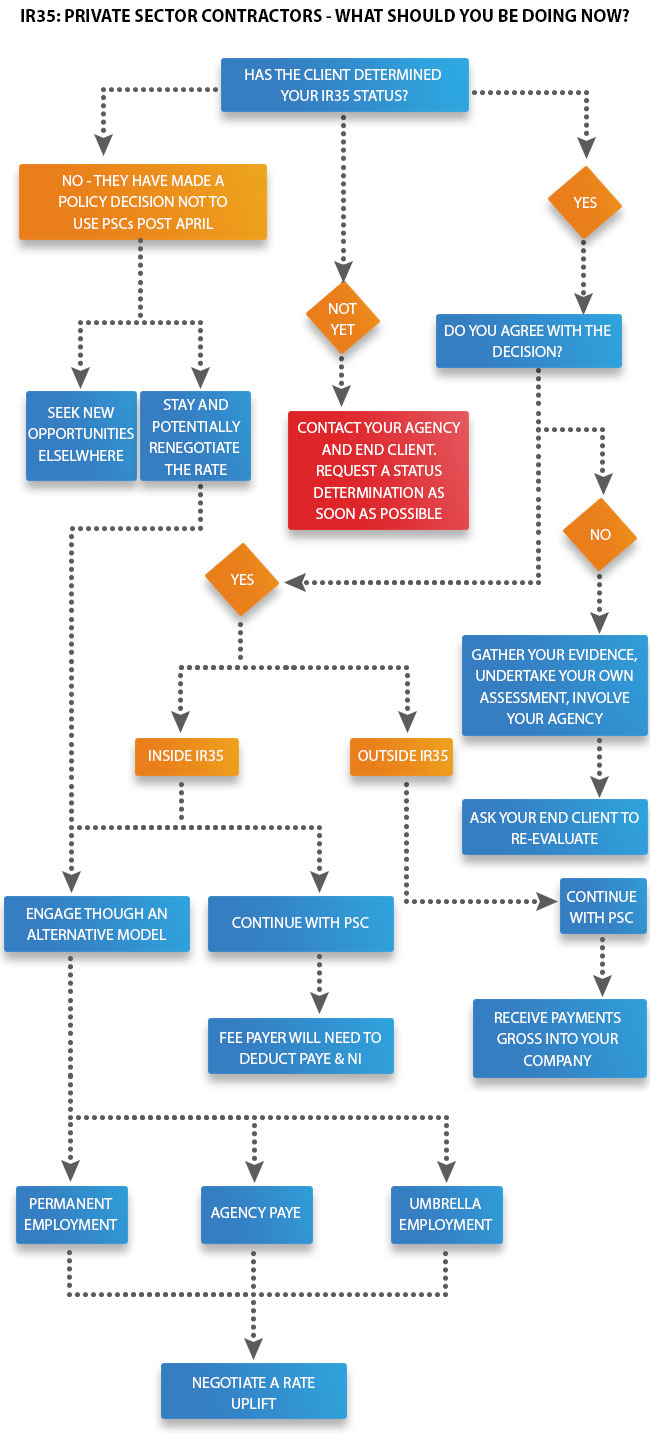

Working Through Hmrc S Off Payroll Ir35 Rules A Step By Step For Pscs

How Will My Take Home Pay Be Affected By Ir35 Sg Accounting

Ir35 Shock As Chancellor Jeremy Hunt Says Contractors Must Pay Same Tax As Employees It Contractor It Contracting News Advice

Ir35 Is Drawing Close Here S How Your Business Needs To Prepare Proclinical Blogs